Life Insurance in and around Lafayette

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

Purchasing life insurance coverage can be a lot to think about with several different options out there, but with State Farm, you can be sure to receive empathetic compassionate service. State Farm understands that your ultimate goal is to protect your partner.

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Love Well With Life Insurance

When picking how much coverage you need, it's helpful to know the factors that play into the type and amount of Life insurance you need. These tend to be things like how old you are, how healthy you are, and perhaps even personal medical history and body weight. With State Farm agent Shawn Hughes, you can be sure to get personalized service depending on your unique situation and needs.

Looking for a life insurance option that even those who thought they couldn't qualify could benefit from? Check out State Farm's Guaranteed Issue Final Expense. It can come in handy to cover final expenses, such as medical bills or funeral costs, without overwhelming your loved ones. Contact your local State Farm agent Shawn Hughes and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Shawn at (303) 665-4600 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

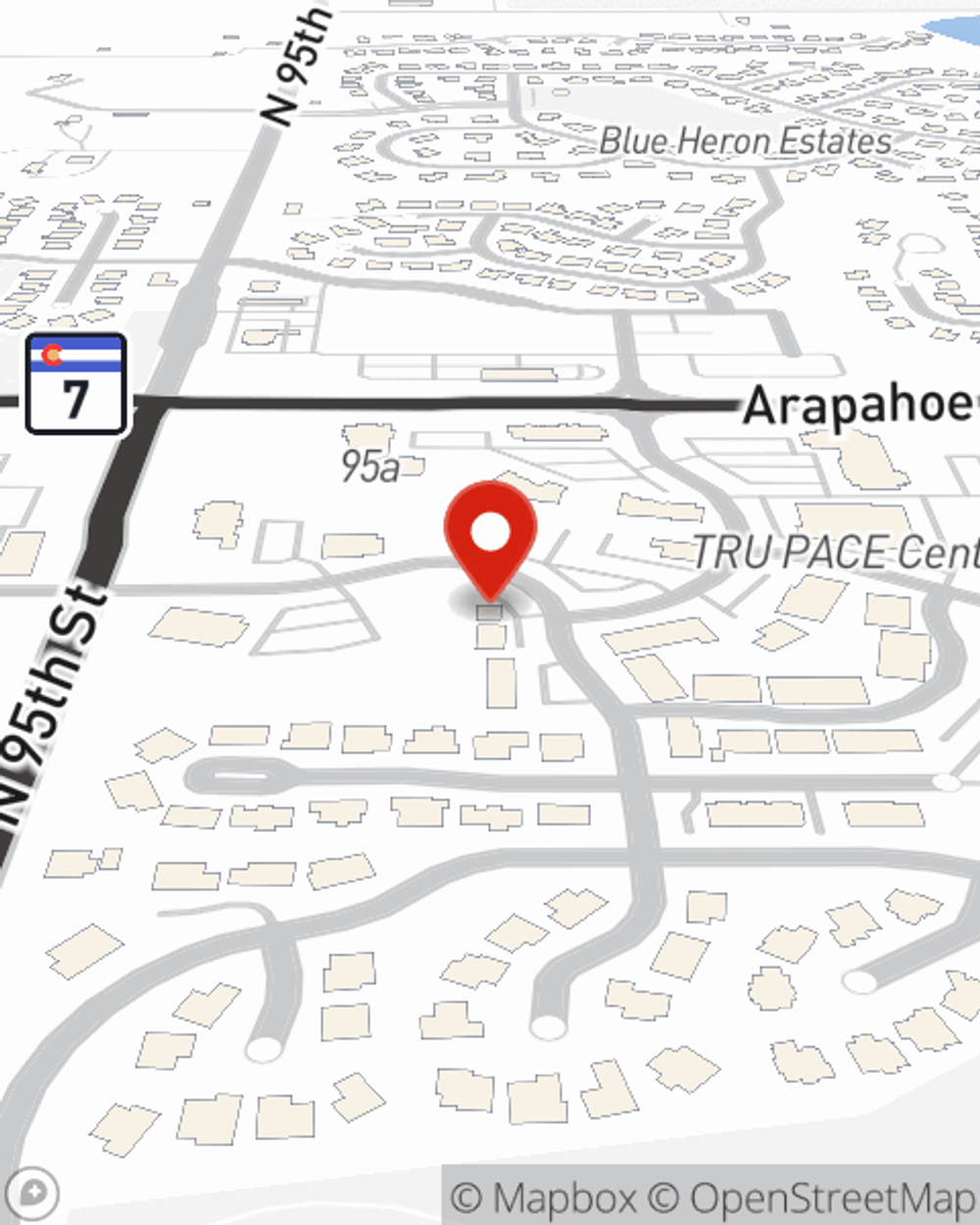

Shawn Hughes

State Farm® Insurance AgentSimple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.